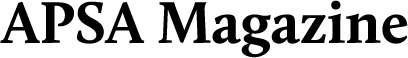

- US export controls now restrict Nvidia’s advanced H20 AI chips from reaching Chinese companies, disrupting China’s artificial intelligence growth and ambitions.

- Nvidia faces crucial decisions: whether to develop new AI chips that meet export rules while still appealing to Chinese clients and maintaining global competitiveness.

- The restrictions could accelerate the rise of Chinese chipmakers, such as Huawei and SMIC, as companies seek alternatives to Nvidia’s hardware.

- The evolving situation may transform the global AI and semiconductor landscape, with competition and technological shifts affecting both Western and Chinese firms.

- Nvidia’s leadership, led by CEO Jensen Huang, remains committed to the Chinese market despite political challenges, signaling the company’s long-term strategic focus.

Anticipation thickens around Nvidia’s next move, as the company known for powering the world’s most sophisticated artificial intelligence abruptly finds itself at a stark crossroads. US export controls have drawn a sharp line in the silicon sand, abruptly shutting Chinese companies out from Nvidia’s advanced H20 chips—once essential building blocks for China’s AI ambitions.

Inside conference rooms stretching from Silicon Valley to Beijing, executives know the stakes. China, the globe’s second-largest economy, refuses to sit idle in the wake of this disruption. Above the whir of fans and circuitry at trade shows in Taipei, enraptured crowds cluster around Nvidia’s dazzling displays. Engineers and investors alike parse every statement from CEO Jensen Huang, whose vision and candor have steered Nvidia into the center of the global AI revolution.

For now, the tech titan’s answer remains elusive. Nvidia’s leadership weighs whether it can design new chips that honor export limits while still satisfying China’s hunger for cutting-edge AI. The company confronts both technical and geopolitical puzzles: how to craft potent AI hardware that doesn’t run afoul of Washington’s new rules, and how to safeguard relationships with its Chinese clientele without drawing further scrutiny.

This isn’t merely a tale of revenue streams or missed shipments. What unfolds could reshape the global AI landscape. China’s titans—Tencent, Baidu, Alibaba—once relied on Nvidia hardware for everything from search engine breakthroughs to self-driving car algorithms. American policy now compels a technological reset, forcing Chinese firms to look inward and potentially supercharging the ambitions of domestic chipmakers such as Huawei and SMIC.

Through it all, Nvidia signals determination. Jensen Huang, at 62, draws on decades of experience navigating global disruption. After the H20 ban, he made a dramatic trip to China, meeting top officials and reaffirming a goal: to keep Nvidia relevant, no matter the challenge. The message to shareholders and competitors is clear—this is not a market Nvidia will abandon lightly.

A glance at the bigger picture reveals a rapidly evolving game. The semiconductor supply chain threads together East and West in increasingly complex patterns. As national security and technological supremacy collide, even giants like Nvidia must move with measured caution. For consumers, tech developers, and industry watchers, the next months will signal whether American innovation and Chinese demand can once again find common ground—or if a new AI cold war is only beginning.

Key Point: Nvidia’s struggle in China highlights the global scramble for AI supremacy, where innovation runs headlong into geopolitics. The outcome will ripple far beyond chip factories, shaping the technology powering tomorrow’s world.

For updates on the tech landscape, explore Nvidia.

Global AI Showdown: What Nvidia’s China Crisis Means for the Future of Artificial Intelligence

Introduction

Nvidia’s pivotal role in the global artificial intelligence (AI) revolution has been placed under the microscope as new US export restrictions abruptly block its advanced H20 chips from entering China’s enormous market. While the headline focuses on high-stakes geopolitics and potential revenue loss, there’s a deeper undercurrent shaping AI’s next chapter—from supply chain disruptions and the rise of Chinese alternatives to the potential onset of an “AI Cold War.” In this article, we’ll explore additional facts, practical implications, and expert insights missed in the source, and finish with recommendations for developers, investors, and enterprises.

—

1. US Export Controls: Details & Impacts

The US Department of Commerce has tightened control over exports of powerful semiconductors to China, specifically restricting chips with certain processing speeds and interconnect capabilities. Nvidia’s H20—one of the most advanced models in the Hopper GPU lineup—falls under these rules, which aim to limit China’s access to high-end neural network training and inferencing.

Notable Facts:

– The enforcement is part of broader US policy that began in October 2022 and intensified in 2023 and 2024, targeting not just Nvidia but also AMD and Intel (source: Bloomberg, Reuters).

– The H20 ban led to an immediate halt in shipments, forcing Nvidia to consider creating “degraded” chips tailored to the new legal limits, similar to previously released A800 and H800 models.

—

2. How-To: Navigating US Export Controls for AI Chips

Steps for Suppliers:

1. Understand Export Classifications: Review chip specs (compute power, bandwidth, interconnect) against US Department of Commerce guidelines.

2. Use Geofencing: Employ supply chain management tools to prevent restricted shipments.

3. Work Closely With Legal Counsel: Ensure ongoing compliance in R&D and sales cycles.

Tip: For developers and enterprises, always check the latest U.S. Bureau of Industry and Security (BIS) updates before committing to multi-year AI infrastructure investments.

—

3. China’s Response: Domestic Chipmakers on the Rise

With Nvidia’s exit from top-tier AI chips in China, major cloud and tech companies (e.g., Alibaba, Tencent, Baidu) are increasingly investing in homegrown chips from companies like Huawei (Ascend AI chips) and SMIC (Semiconductor Manufacturing International Corporation).

Insights:

– Huawei’s Ascend 910B, manufactured with SMIC’s 7nm process, has been seen running large language models in recent tests, providing a competitive, if less efficient, alternative to Nvidia’s silicon.

– Chinese policymakers are pouring billions into national chip self-sufficiency, as outlined in the “Made in China 2025” initiative (source: South China Morning Post).

—

4. Market Forecasts & Industry Trends

Global AI Chip Market: Expected to reach a $300 billion valuation by 2027, with China aiming to capture 30%+ of the market share (source: Statista, McKinsey).

Industry Shifts:

– US and European cloud providers may enjoy a temporary lead, but China’s R&D machine is rapidly accelerating.

– Startups in China are innovating at every level, from alternative chip architectures to AI accelerators focused on energy efficiency.

—

5. Reviews & Comparisons: Nvidia H20 vs. Huawei Ascend 910B

Feature | Nvidia H20 | Huawei Ascend 910B

— | — | —

Architecture | Hopper | Da Vinci

Process Node | 4-5nm (TSMC) | 7nm (SMIC)

Peak Performance (FP16) | ~90 TFLOPS | ~320 TFLOPS

Ecosystem | CUDA, cuDNN, TensorRT | CANN (Chinese AI framework)

Availability | Banned in China | National priority in China

Expert Review: While the Ascend 910B lags in software ecosystem depth and energy efficiency, it’s improving fast and now supports major Chinese machine learning frameworks.

—

6. Security & Sustainability

Security: US restrictions aim to curb risk of AI chips being used in military and surveillance applications. However, increased development of in-house chips may limit US visibility and control.

Sustainability: Cutting-edge chips like Nvidia’s consume tremendous energy. As more domestic Chinese chips come online, data center power use may skyrocket unless efficiency improves (source: International Energy Agency).

—

7. Controversies & Limitations

– Controversy: Critics argue export bans may backfire by accelerating Chinese innovation and reducing US industry’s leverage over global standards.

– Limitation: Chinese substitutes are less advanced, creating a temporary setback for domestic AI projects.

—

8. Real-World Use Cases: Who is Impacted?

– AI startups that relied on Nvidia hardware for deep learning training.

– Cloud platforms operating language models and generative AI (chatbots, image generators).

– Automotive firms developing self-driving vehicles and AI-enabled navigation.

—

9. Pros & Cons Overview

Pros:

– Strengthens US national security.

– Spurs innovation and supply chain resilience.

Cons:

– Splits the global AI ecosystem.

– Delays or degrades performance for Chinese AI applications.

—

10. Pressing Questions & Expert Answers

Q: Will Nvidia design new “export-compliant” chips for China?

A: History suggests it will try, but US regulators can tighten rules at any time.

Q: Is this the end of US chips in China?

A: Not entirely, but the era of unfettered access to top-end US chips is over.

—

11. Actionable Recommendations & Quick Tips

– For AI developers: Diversify hardware dependency. Master both CUDA and open-source Chinese alternatives.

– For investors: Monitor the performance of Chinese chipmakers and Nvidia’s compliance strategies.

– For business leaders: Plan for supply chain shocks by assessing global semiconductor risks.

—

Conclusion

Nvidia’s China crossroads represent not just a business hurdle but a seismic shift that will echo through global AI development, security, and innovation. Staying informed and agile is the best way to thrive in this uncertain—but exciting—new era.

For the latest updates on chip innovations and company moves, bookmark the official Nvidia page.

This post Nvidia’s Bold Gamble: What’s Really Happening Behind the Scenes in China’s AI Race? appeared first on Macho Levante.