“Every recession carries within it the seeds of a new boom.”

It’s a sentiment echoed by economists, historians, and policymakers alike — because while recessions are disruptive, they are also part of a natural economic rhythm. History tells us that economic downturns, however severe, are rarely permanent. From the Great Depression to the COVID-19 crisis, economies have found paths to recovery, resilience, and even reinvention.

But how exactly does an economy climb out of a recession? Economic recovery after recession? What mechanisms trigger a rebound, and what role do policy, innovation, and public confidence play in shaping the outcome?

In this deep dive, we break down the journey from economic contraction to recovery, spotlighting key principles, strategies, and real-world examples that reveal how nations bounce back.

Understanding Recession: A Quick Primer

A recession is typically defined as two consecutive quarters of negative GDP growth. It often coincides with rising unemployment, declining consumer spending, faltering business investment, and slowing industrial production.

Recessions can be triggered by various shocks:

- Financial crises (e.g., 2008)

- Pandemics (e.g., COVID-19)

- Energy price shocks

- Geopolitical events or wars

- Policy missteps

While every downturn is unique, the common thread is economic contraction and reduced activity, economic recovery after recession — and reversing that trajectory requires coordinated effort, time, and often a bit of ingenuity.

Phase One: Stabilization

“Stop the bleeding before healing begins.”

The first step in economic recovery after recession is halting the economic freefall. In this phase, governments and central banks step in aggressively to stabilize markets, inject liquidity, and rebuild confidence.

Key tools:

- Monetary easing: Central banks lower interest rates to encourage borrowing and investment. In more severe cases, they may pursue quantitative easing — purchasing government securities to inject cash into the financial system.

- Fiscal stimulus: Governments may roll out spending programs, infrastructure projects, tax cuts, or direct cash transfers to households and businesses.

- Financial sector rescue: During crises like 2008, governments recapitalize or bail out struggling banks to prevent systemic collapse.

Example:

During the COVID-19 pandemic, the U.S. Federal Reserve cut interest rates to near zero, while Congress launched multi-trillion-dollar relief packages — a combined move that helped prevent a deeper depression.

Phase Two: Repairing Confidence

Confidence is the fuel of any economy. After stabilization, the next step is restoring optimism among consumers, businesses, and investors. Why? Because recovery depends heavily on expectations about the future.

Signs of renewed confidence:

- Stock markets recover and capital begins to flow into riskier investments.

- Consumer spending rebounds, especially in discretionary sectors like travel and entertainment.

- Businesses restart hiring and capital investments.

- Exports and global trade begin to pick up.

Psychologically, people must believe that “the worst is behind us” before they change behavior. This is why clear communication from governments and financial institutions — explaining recovery strategies and maintaining transparency — plays a vital role.

Phase Three: Real Growth Returns

This is the stage where economic recovery after recession takes root. Unlike the artificial lifeline of stimulus, real growth must be organic and sustainable. Economies that emerge stronger tend to have a few core ingredients in common:

1. Resilient Infrastructure & Investment

Governments that use crises as an opportunity to invest in infrastructure, technology, and public goods often emerge with more robust economies. Think: roads, digital infrastructure, green energy, and education.

Example:

Post-World War II, the United States invested heavily in public infrastructure through the GI Bill and highway systems, laying the foundation for decades of growth.

2. Innovation-Led Rebuilding

Crises often spark entrepreneurship and innovation. New problems create demand for new solutions — and that leads to entire sectors being born or reborn.

Example:

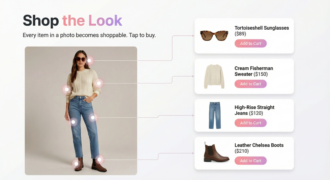

After the 2008 crisis, fintech saw rapid acceleration. Post-COVID, we witnessed explosive growth in remote work tools, digital health, and e-commerce infrastructure.

3. Labor Market Realignment

Recessions displace workers — but economic recovery after recession depends on how quickly labor adapts. Workforce retraining programs, skill development, and mobility all help economies regain productive capacity.

Challenges on the Road to Recovery

Recovery isn’t always smooth. Several factors can delay or derail progress:

- Persistent inflation or supply chain bottlenecks

- Rising national debt and reduced fiscal space

- Geopolitical instability (e.g., war, trade wars)

- Policy errors such as premature tightening of monetary policy

Recovery is also uneven across regions and populations, often widening income gaps. That’s why inclusive recovery plans — targeting small businesses, marginalized communities, and vulnerable workers — are essential for long-term stability.

The Role of Global Coordination

Today’s world is more interconnected than ever. As such, economic recovery is rarely isolated. International cooperation through institutions like the IMF, World Bank, G20, and WTO plays a crucial role.

Trade partnerships, debt relief, and coordinated stimulus efforts help avoid zero-sum outcomes and ensure that recovery efforts are globally sustainable.

Lessons from Past Recoveries

History offers powerful lessons:

- The Great Depression (1930s): Taught us the danger of austerity during downturns. Real recovery began only when public spending surged during WWII.

- 2008 Financial Crisis: Highlighted the importance of banking regulation and the need for global liquidity backstops.

- COVID-19 Pandemic: Proved the value of fast stimulus, agile governance, and the digital economy’s central role in resilience.

Each recovery has reshaped the world in lasting ways — economically, socially, and politically.

Final Thoughts: The Phoenix Pattern of Growth

Recessions are painful. They cost jobs, close businesses, and create anxiety about the future. But they also clear out inefficiencies, reveal systemic flaws, and force reinvention. The most resilient economies are those that not only bounce back but bounce forward — building a future shaped by lessons learned and opportunities seized.

From recession to recovery, the journey is rarely linear. But with the right tools, smart policy, and public cooperation, a stronger, more adaptive economy often emerges from the ashes.

In the words of Winston Churchill:

“Never let a good crisis go to waste.”