Non-fungible tokens, or NFTs, burst into the mainstream with million-dollar auctions, celebrity endorsements, and viral pixelated avatars. But amid the hype and headlines, a key question continues to surface: What actually makes an NFT valuable?

Is it the art? The creator? The utility? Or is the whole thing driven by digital groupthink?

As it turns out, the value of an NFT isn’t only about what’s on-chain—it’s also what’s in our minds. To truly understand why some NFTs sell for millions while others fade into obscurity, we must explore the interplay of technology, scarcity, cultural trends, and, most importantly, market psychology.

1. Scarcity: The Psychology of Limited Supply

The first rule of value? Scarcity creates desire. NFTs are unique by design—each token is verifiably distinct and stored on a blockchain, making duplication impossible.

But the psychological driver here is perceived rarity. When a digital asset is limited to 1 of 1—or even 1 of 10,000—it creates a fear of missing out (FOMO).

This mirrors traditional markets:

- Think of how people chase limited-edition sneakers or art prints.

- The moment a collection “sells out,” its desirability increases.

In NFTs, collections like CryptoPunks or Bored Ape Yacht Club capitalized on this mindset. Their capped supply meant early buyers got exclusivity—something many latecomers were willing to pay a premium for.

Key takeaway: Scarcity taps into our primal fear of exclusion—and that emotional response directly fuels price momentum.

2. Community and Social Signaling

Humans are tribal by nature. We crave identity, status, and belonging. NFTs provide a new form of digital self-expression and social signaling, especially in Web3 communities.

When someone buys into an NFT project, they’re often joining a tight-knit digital club. PFP (profile picture) NFTs like Doodles, Azuki, and BAYC act as badges of status across platforms like Twitter, Discord, and Instagram.

More importantly, communities create shared culture:

- Inside jokes

- Member-only access

- Exclusive events and merchandise

People are willing to pay not just for the image, but for the identity and access it represents, valuable NFT. This is why some NFTs become cultural assets rather than mere collectibles.

Market insight: The stronger the community and brand narrative, the more durable the NFT’s value.

3. Creator Reputation and Storytelling

Just as traditional art relies on the prestige of the artist, NFTs are heavily influenced by who creates them.

Collectors value:

- Proven track records

- Artistic vision

- Unique narratives

For instance, Beeple’s “Everydays: The First 5000 Days” fetched $69 million not just because of the visuals, but because it chronicled 13 years of daily art-making. The story was the product.

Emerging artists can also gain traction by:

- Building in public

- Engaging with collectors

- Offering transparency in their process

A compelling narrative—whether around the creator, the journey, or the ethos—can turn an average NFT into a sought-after cultural artifact.

Psychology at play: People don’t just buy the product—they buy the story behind it.

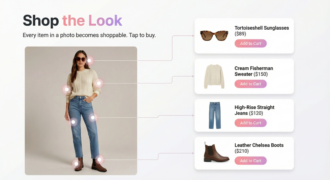

4. Utility and Functionality

Not all NFTs are art. Many offer real-world or digital utility, which introduces tangible value to the token beyond aesthetics or status.

Examples include:

- Access: NFTs that unlock private communities, events, courses, or premium content

- Revenue: Royalties or staking yields

- Gaming: In-game items, land, or characters with utility in metaverse environments

- Token-gated commerce: NFTs that give holders discounts, early access, or exclusive drops

When an NFT becomes a functional asset, it appeals not just to collectors, but to users—people who want to do something with it.

The shift from speculative art to functional asset class is reshaping how NFTs are valued—moving beyond sentiment to use-case-driven demand.

5. Speculation, Momentum, and Market Trends

Let’s be honest: much of the NFT valuable boom has been fueled by speculation.

Psychologically, markets tend to overvalue emerging technologies during hype cycles (see: dot-com boom). In NFT markets, this is often seen in:

- Sudden price spikes following influencer tweets

- “Pump and dump” patterns in low-cap collections

- Trend-chasing behavior around buzzwords like “AI NFTs” or “Ordinal NFTs”

FOMO, coupled with herd mentality, drives irrational price movement. People chase green candles and join mints hoping for quick flips.

But this speculative layer also has a purpose: it brings liquidity, attention, and experimentation to a new frontier.

Warning: High speculation often leads to volatility. Value built on hype rarely lasts—unless it’s backed by real innovation or community depth.

6. Cultural Relevance and Timing

An often-overlooked aspect of NFT valuation is zeitgeist—whether a project captures a moment in time.

NFTs that intersect with:

- Pop culture

- Memes

- Social movements

- Political commentary

…tend to resonate deeply, especially if launched during culturally significant windows.

Take FreeRoss NFTs that support Ross Ulbricht or meme-inspired collections like Pepe derivatives. Their value is symbolic—they are statements as much as assets.

When an NFT aligns with a cultural mood or moment, it gains value through emotional and historical context—not just design.

Conclusion: Value Is as Much Psychological as It Is Technological

So, what makes an NFT valuable?

It’s not just blockchain integrity, visual design, or scarcity. It’s belief—the collective trust that what you own means something, whether financially, socially, culturally, or functionally.

In many ways, NFTs are mirrors—reflecting what we find important as individuals and as a society. They are:

- Symbols of status

- Tickets to digital tribes

- Vehicles of expression

- Bets on creators and communities

Understanding NFT value is about more than smart contracts and tokenomics. It’s about understanding people—their desires, fears, and dreams.

And in the ever-evolving world of Web3, that psychology may be the most powerful currency of all.