- AI tokens are revolutionizing India’s tech scene by combining artificial intelligence and blockchain, creating autonomous digital economies and programmable value.

- Major projects like Near Protocol, ICP, The Graph, Render, and SingularityNET drive surging trading volumes and real-world utility beyond speculation.

- Unlike meme coins, AI tokens power automation, predictive analytics, fraud detection, and monetize unused computing resources, attracting institutional investors like BlackRock and Grayscale.

- India is a global leader, accounting for 17% of new Web3 developers with rapid growth in GitHub activity, powered by robust talent and VC investments.

- Security, accountability, and regulatory clarity are vital as decentralized AI agents autonomously transact, introducing new risks alongside opportunities.

- The fusion of AI and blockchain is a lasting transformation, rewarding innovation, open collaboration, and active participation in next-gen digital economies.

A restless energy hums through the digital corridors of India’s tech community. Here, a bold alliance is forming at the intersection of artificial intelligence and blockchain—unlocking not just virtual currencies, but entire ecosystems run by autonomous, self-improving agents. These platforms aren’t speculative playgrounds; they are reshaping finance, data, and utility for a new era.

A Marketplace of Minds—And Machines

Rows of code ripple across GitHub as Indian developers breathe life into projects like Near Protocol, Internet Computer (ICP), The Graph, Render, and SingularityNET. Trading volumes for these “AI tokens” are swelling, often touching the $10 million mark each month on Indian exchanges, signaling surging interest far beyond mere enthusiasts.

Yet the real story isn’t just in the numbers, even as global AI token market capitalization catapults from $2.7 billion to nearly $30 billion inside a year. The heart of this movement lies in utility: AI tokens weave together real-world use and digital autonomy. Developers aren’t just swapping coins—they’re building, collaborating, and competing, relying on decentralized infrastructures that reward contribution and innovation.

More Than Just Coins—It’s Programmable Value

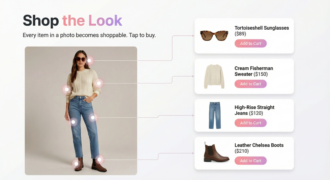

AI tokens break from the tradition of digital currency as a passive store of value. On platforms like Render, individuals monetize idle GPUs, transforming unused computing power into a stream of income. Fetch offers a bustling marketplace, where developers deploy AI agents—algorithms that autonomously execute tasks, analyze data, and even transact on blockchain networks. Each time these agents serve a purpose, their creators reap rewards.

The distinction is vivid: unlike the fleeting trend of meme coins, AI tokens are moored to transformative technologies—automation, predictive analytics, fraud detection, and more. Their ability to independently optimize transactions has caught global investor attention. Powerhouses like Grayscale, BlackRock, and Fidelity are rapidly increasing stakes in decentralized AI projects, energized by the possibilities of programmable, autonomous value.

India’s Deepening Footprint

India, long the nerve center of global IT, is now surging ahead as a critical architect of the AI+Web3 frontier. The country accounts for 17% of the world’s new Web3 developers, with GitHub activity growing at a chart-topping 28% annually in 2024. This momentum reflects not only a broad and sophisticated talent pool but a hunger to shape digital futures—contributing to open-source repositories, competing in world-stage hackathons, even curating datasets for decentralized applications like Ocean Protocol.

Venture capital hasn’t missed the signal: AI+Blockchain startups around the world have secured $436 million in 2024 alone—double the outlay from last year—with marquee investors like a16z, Binance Labs, and Peter Thiel’s Founders Fund pouring in.

A Promised Land—With Perils

Every innovation carves out new risks. Fully autonomous AI agents can execute smart contracts, move assets, and approve transactions without a single human touch—all a recipe for efficiency, but also for exposure. Malicious actors may exploit vulnerabilities, while errant algorithms could trigger substantial, unintended outcomes. The absence of clear accountability in code-based transactions poses thorny legal questions.

Security and regulatory clarity, always crucial in financial sectors, climb even higher on the agenda. As AI-driven protocols escalate in complexity and reach, governments worldwide are scrambling to craft rules, hoping to balance safety without strangling innovation.

The New Digital Compact

AI tokens blend decentralized trust and machine intelligence into something astonishingly potent. Far from a passing fad, this is a foundational shift—fueling new business models, rewarding open collaboration, and granting participation in the world’s first truly autonomous digital economies.

The next few years promise rapid acceleration. Talent-rich nations, visionary investors, and relentless developers will test, break, and reinvent the rules—ultimately co-authoring a decentralized future where humans and machines earn, build, and decide together.

The takeaway is clear: those who understand, engage, and innovate at this frontier will not just witness change—they will own it.

India’s AI-Blockchain Revolution: How Tokens & Autonomous Agents Are Quietly Rewiring the Digital Economy

Introduction: India Takes Center Stage in AI + Blockchain

India’s tech community is at the heart of a seismic shift where artificial intelligence and blockchain technologies combine to create not just new digital tokens, but entire self-governing ecosystems. Unlike the fleeting boom-and-bust cycles of meme coins, these AI tokens are fundamentally redefining how value, automation, and innovation operate across industries.

Below, we present crucial facts, market trends, real-world use cases, and actionable insights for anyone looking to understand, invest in, or leverage India’s rapidly expanding AI token landscape.

—

Additional Facts, Trends & Industry Insights

1. Major Real-World Use Cases

– DeFi Infrastructure: AI tokens are powering decentralized finance (DeFi) protocols by automating market-making, lending, and risk assessment processes (source: Coindesk).

– Healthcare: Projects like SingularityNET enable secure, decentralized access to AI diagnostic tools, reducing data silos and patient privacy risks.

– Supply Chain Optimization: Blockchain’s traceability combined with AI’s predictive analytics is streamlining logistics and fraud detection for Indian exporters (source: Gartner).

2. How-To Steps & Life Hacks

How to Earn with AI Tokens:

1. Acquire Tokens: Buy AI tokens like $AGIX (SingularityNET), $RNDR (Render), or $GRT (The Graph) on exchanges.

2. Deploy Services: Run an AI agent or provide computing resources (e.g., GPUs on Render) to earn passive rewards.

3. Participate in Governance: Vote on ecosystem proposals and shape protocol evolution.

4. Contribute Code/Data: Join open-source projects to receive ecosystem incentives.

3. Reviews & Comparisons

| Project | Features | Pricing Model | Notable Backers |

|——————-|——————————|—————-|—————————|

| SingularityNET | AI marketplace, data privacy | Staking-based | Cardano, Hanson Robotics |

| Render Network | Decentralized rendering | Pay-per-GPU | OTOY, Multicoin Capital |

| The Graph | Data indexing for blockchains| Indexer rewards| Tiger Global, Coinbase |

| Fetch.ai | Autonomous agent marketplace | Dynamic/usage | Outlier Ventures |

4. Security, Limitations & Controversies

– Smart Contract Exploits: AI agents can inadvertently execute flawed or malicious code, leading to asset loss (notable example: The DAO hack of 2016—source: Coindesk).

– Regulatory Uncertainty: India’s stance on cryptocurrencies remains ambiguous, with no comprehensive framework specifically for AI-powered blockchains yet.

– Accountability Gap: If an autonomous agent malfunctions, it is unclear who is liable—the creator, the platform, or no one? Legal experts continue to debate this.

5. Market Forecasts & Trends (2024–2027)

– AI token market cap could reach $50 billion by 2027 (source: Messari.io, Morgan Stanley analysts).

– Web3 Developer Growth: India will likely outpace the global average, driven by local hackathons, university programs, and a digitally native population.

– Institutional Adoption: After pioneers like BlackRock, expect more hedge funds and banks to experiment with AI asset management on-chain (source: BlackRock).

6. Pros & Cons Overview

Pros:

– Decentralized and censorship-resistant

– Rewards for real computational or creative work

– Transparent transactions and smart contracts

Cons:

– Volatility and nascent regulation

– Steep learning curve for non-developers

– Environmental impact (depending on consensus method)

—

Most Pressing Reader Questions—Answered

Q: How can beginners get involved in India’s AI + Blockchain ecosystem?

– Start by joining local Web3 developer meetups.

– Contribute to open-source projects on GitHub.

– Consider small investments in leading tokens after researching platforms (never invest more than you can afford to lose).

Q: Are AI tokens legal and safe in India?

– Crypto regulations in India are evolving. Currently, trading is not banned but is taxed; safety depends on your due diligence and platform reputation.

– Always use official wallets/exchanges, enable two-factor authentication, and keep private keys offline.

Q: Which Indian startups are leading in this space?

– Notables include Polygon (Ethereum scaling, now integrating AI), Persistence, WazirX, and Covalent—many with teams based in Bangalore and Hyderabad.

—

Actionable Recommendations & Quick Tips

1. Diversify your portfolio: Don’t just buy tokens—get involved in development or staking.

2. Learn Solidity or Python: These languages are most used for blockchain/AI smart contracts.

3. Regularly check security: Update wallets, revoke unnecessary token permissions, and use hardware wallets for storage.

4. Stay Informed: Follow reputable news outlets like Coindesk and Gartner for regulation and innovation updates.

—

Conclusion

India is not just a participant—it’s a prime architect in the global AI + Web3 revolution. For those willing to learn and adapt, AI tokens open doors to automated economies, peer-to-peer income, and future-proof careers.

Quick Tip: Start small—experiment with a demo wallet and join community forums. The earlier you act, the bigger your edge in tomorrow’s decentralized world.*

—

Related links:

– Coindesk

– BlackRock

– Gartner

– GitHub

This post The Secret Surge Behind AI Crypto: What’s Unleashing the Next Digital Gold Rush? appeared first on Macho Levante.